|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

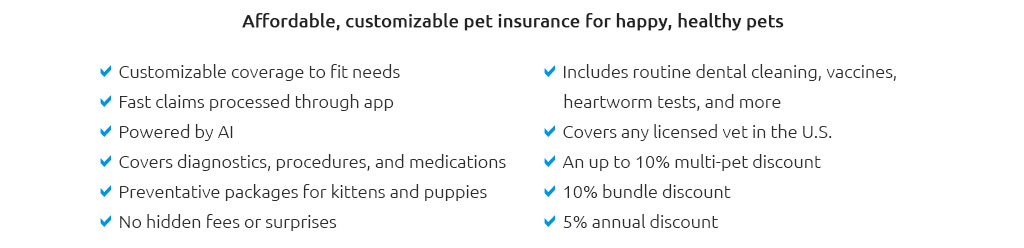

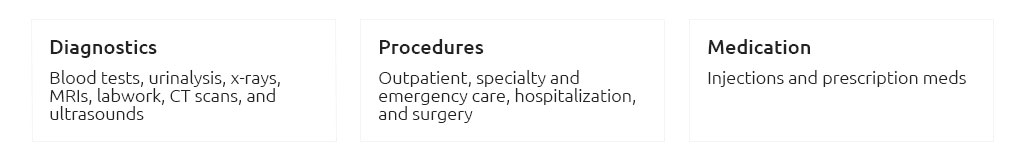

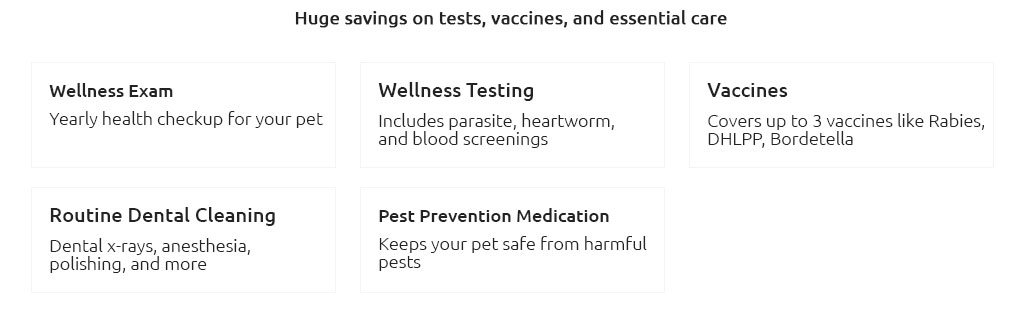

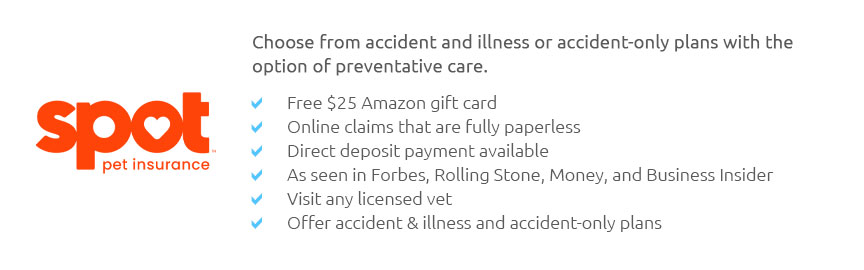

Exploring Health Insurance for My Canine CompanionIn the ever-evolving landscape of pet care, the concept of health insurance for dogs has gained significant traction, sparking interest and, occasionally, skepticism among pet owners. As a devoted dog parent, the decision to invest in health insurance for my furry friend wasn't one I took lightly. Ensuring the well-being of our canine companions is paramount, yet the process of selecting a suitable insurance policy can be daunting. In a world where veterinary care costs are skyrocketing, it's worth pondering whether pet insurance is a wise investment or simply an unnecessary expense. When my energetic Labrador Retriever, Max, suffered an unexpected injury during one of our weekend hiking adventures, the value of having a comprehensive insurance plan became undeniably apparent. The veterinary bills quickly piled up, and I was grateful for the foresight to have secured coverage. Many dog owners share similar stories, and their experiences provide valuable insights into the real-world benefits of pet insurance. To understand the intricacies of dog health insurance, one must first acknowledge the range of options available. These policies often cover a variety of scenarios, from routine check-ups to emergency surgeries. For instance, basic plans typically cover accidents and illnesses, while more comprehensive plans may include preventive care, vaccinations, and even alternative therapies like acupuncture or hydrotherapy.

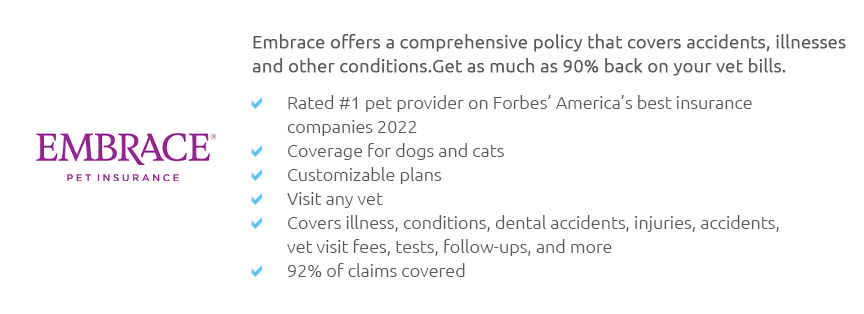

Choosing the right policy involves careful consideration of various factors. For instance, the breed, age, and pre-existing conditions of your dog can influence both the cost and the coverage options available. Many insurers offer customizable plans, allowing pet owners to select coverage that aligns with their financial situation and their pet's specific needs. It's worth noting that while pet insurance can be a financial lifesaver in emergencies, it is not without its limitations. Exclusions and waiting periods are common, and understanding these terms is crucial to avoid unpleasant surprises. Some policies may not cover hereditary conditions or may impose annual caps on reimbursements. Ultimately, the decision to purchase health insurance for your dog is a personal one, influenced by factors such as financial stability, risk tolerance, and the health of your pet. For me, the peace of mind knowing that Max is protected against unforeseen health issues outweighs the monthly premium. After all, our pets are cherished members of our families, and their health deserves careful consideration and planning. https://www.aspcapetinsurance.com/dog-insurance/

Pet insurance can help you take great care of your dog when they get hurt or sick. It reimburses you for covered veterinary expenses, so you can provide them ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

MetLife, Embrace and Pets Best top our list of the best pet insurance companies. See which one is right for you. https://www.petinsurance.com/

A pet insurance plan lets you give your furriest family members the best health care possible by reimbursing you for eligible veterinary costs.

|